[miningmx.com] – The 70% jump in the Anglo American Platinum (Amplats) share price from R166 on January 8 to current levels around R290 is justified despite the continuing poor outlook for platinum, according to CEO Chris Griffith.

Platinum shares have moved up sharply over the past month with Amplats followed by Impala Platinum (Implats) which is 55% higher at around R40 and Northam Platinum up 26% to around R39.

The reason – according to various market commentators – is the recent weakness in the US dollar which has caused some investors to call a possible bottom for plunging commodity prices.

According to JP Morgan Cazenove analysts Allan Cooke and Abhishek Tiwari “market optimism toward mining stocks on the back of a weaker US dollar and a firmer oil price helped SA listed PGM equities too.’

But the analysts sounded a warning that “we see the stocks volatile near term as market sentiment around Fed rate hikes and US dollar strength oscillates’ adding that, ” in this challenging business environment we foresee a difficult 2016 for SA platinum producers.’

The overall outlook is still one of grim global economic and platinum market conditions which Griffith described in Amplats results statement for the year to end-December as “tough’ and “depressed’.

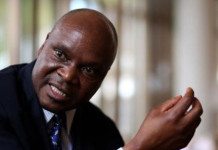

But Griffith told Miningmx that, “speaking specifically for Anglo American Platinum I believe the shares have way overshot on the downside. It’s too soon to call a change in the market but I am of the view that we are returning to a more normal price level.

“I think conditions will continue to be volatile but I believe the fundamentals for PGM are still fairly good and the recovery in our share price is justified.’

While investor sentiment may be improving towards the platinum shares the situation in Zimbabwe – where Amplats owns the Unki mine and Implats controls the Zimplats and Mimosa operations – appears to have taken another turn for the worse.

According to Amplats , a notice published by Zimbabwe’s Minister of Youth, Indigenisation and Economic Empowerment on January 8 stated that the 51% indigenisation requirement for the resource sector is to be met through an exchange of “the mineral resource being exploited and at no monetary cost to the Government.’

That looks drastic because, if implemented, it would amount to effective nationalisation of the country’s mines. Also, in Amplats’ case, the group already has a deal in place because it signed a “heads of agreement’ with the Zimbabwean government in November 2012 after government approved its indigenisation plan.

But this latest threat was played down by Amplats executive July Ndlovu in reply to a question from an analyst at the group’s results conference held in Cape Town today.

Ndlovu described the notice issued as being “similar to a White Paper being released in South Africa which is intended to allow discussion to take place. It does not change any Act of Parliament. We are engaging with the Zimbabwean government and think we are making relatively good progress in terms of finding each other.’

Asked by Miningmx for his response Griffith replied, ” we have an indigenisation deal and we will defend our rights. Engagements with the Zimbabwean government are on-going and the Company is not yet certain of the impact of the general notice on the proposed Unki indigenisation transaction.’