[miningmx.com] – EXXARO Resources is not the only mining company that considered itself bullet-proof following the uplift provided by the so-called commodities supercycle.

Yet its decision to spend R2.56bn on a greenfields iron ore project in the Republic of Congo (RoC) before it had finalised a port and rail framework agreement for the project seems – with the benefit of hindsight – extremely bold.

“We believed there were some good reasons why wanted to be a first mover,’ said Wim de Klerk, CFO of Exxaro Resources in a conference call to investors and media today. “We realised there would be risk and the board took an informed decision to put some capital to that risk. We have now lost two years of not been able to conclude the definitive agreements’.

The outcome is a write-down that could total R5.36bn representing Exxaro’s entire investment in the project, known as Mayoko, with no certainty that it will ever proceed. It will try, however, to take the venture forward.

De Klerk said the company had given itself six months to find a solution, specifically on rail tariffs, with the Congolese.

The issue turns on the fact that for Mayoko to pass muster it needs to ramp-up to 12 million tonnes a year (mtpa) of iron ore production – more than double the capacity of the current rail route, some 460km from Mayoko to Pointe Noire on the coast.

The RoC has long made its intention known that it is seeking an expansion of the rail and port network that is multi-user and open-access so that the country’s broader economy can benefit, whereas Exxaro Resources seems to want exclusive use – an assertion De Klerk denies. “Exclusivity is not the issue,’ he said. Funding the expansion is, however.

For Exxaro to move the iron ore it believes makes economic sense for the project, an expansion of the rail route to Pointe Noire would have to be far in excess of 12mtpa, especially as Exxaro’s RoC neighbour, Equatorial Resources, wants to export 2mtpa of iron ore from its own project, Mayoko-Moussandji down the line.

“I don’t think Exxaro will be the sole provider of capital to the region,’ said John Welborn, CEO and MD of Equatorial Resources. “The RoC government has been consistent in asking for an open-access rail line in the region,’ he said.

What’s required for Exxaro now is to agree a tariff with the RoC government that compensates it for the outlay it envisages.

It will continue to spend R300m on the project as committed, but has already set down plans to sell capital goods, such as locomotives in order to recoup its investment, a move that will continue even if a framework agreement on the port and rail is agreed with the RoC, said De Klerk.

Another complication for the Mayoko project is that the resource is below expectations, hence the need to lift volumes (Exxaro previously planned a 10mtpa project) while the iron ore price hasn’t helped – down from the $140/t when Exxaro first bought into the project in the R2.8bn takeout of Australia’s African Iron to around $90/t today – although the project is modelled on $80/t.

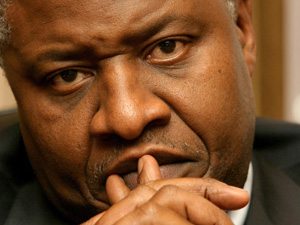

Sipho Nkosi, Exxaro CEO, attempted to remain positive, which is his style, but he sounded uncharacteristically downbeat.

“We wish to assure you that Exxaro continues to work with the RoC government and will maintain the support to the surrounding Mayoko community. We are committed to a new rail and port deal that will make it [Mayoko] viable,’ he said.

“If the agreement is favourable, then Exxaro will be in position to consider the next steps regarding the future. Therefore, the way forward is for Exxaro to finalise all definitive agreements as soon as possible. We will engage the RoC government as this remains an important project for Exxaro and the economy of the RoC,’ he said.

The flipside is that Exxaro exits the RoC – its first major dash at establishing itself as an independent operator of iron ore – possibly selling the prospect to Equatorial Resources that once owned a 20% stake in African Iron, Mayoko’s owner until 2012. Said Welborn; “We’ve long thought the two projects would benefit from working together,” he said.

Said De Klerk: “Selling is a consideration, but it is too early to comment on that option.

Shares in Exxaro ended 2.87% down on the Johannesburg Stock Exchange.