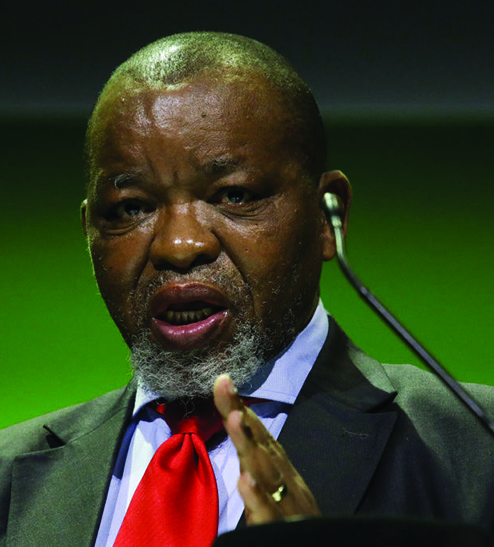

Andries Van Heerden

CEO: Afrimat

‘I really enjoy my job and see myself doing it for a while’

VAN Heerden described the first half of Afrimat’s 2025 financial year as “the most challenging”. That’s largely because iron ore sales were affected by kiln outages at major customer ArcelorMittal SA. Predictably, logistical bottlenecks on the iron ore line, run by South Africa’s state-owned rail and ports utility, Transnet, also played a part. Van Heerden doubts there will be an immediate improvement at Transnet, but the groundwork for recovery is being laid.

Cement business Lafarge, acquired last year from Holcim for $6m, also dragged down profits. Yet again, a turnaround is in the works in relatively quick time. Despite these shocks, shareholders are likely to look through the short-term pain since buying smart and restoring unloved assets has been the Afrimat way for many years. The flip side to this acquisition strategy is to know when to quit. In 2022 Van Heerden walked away from the purchase of Gravenhage, a Northern Cape manganese deposit, because the water licence was deemed too restrictive. He also dropped out of the bidding for Universal Coal, citing costs and complexity.

The acquisition of Lafarge, which also produces aggregates and fly ash, was finalised in the first half of 2024. Van Heerden says Lafarge’s aggregates assets are well situated despite the Lichtenburg factory suffering neglect. Lafarge will pay for itself quickly. South African businesses are enjoying a post-election improvement in business confidence, says Van Heerden, who adds he’s “optimistic by nature”.

LIFE OF ANDRIES

Van Heerden holds a degree in mechanical engineering and an MBA. Since leading Afrimat’s listing on the JSE in 2006, he successfully diversified the group beyond its original focus on quarrying into broader industrial minerals and then coal, manganese and iron ore mining. In recent years, he has added phosphates and rare earth minerals. Many of the company’s most successful acquisitions were businesses facing liquidation, which have been turned around. Van Heerden, who turned 59 in 2024, says he has had “a lot of fun” as CEO of Afrimat and has no plans to retire early.