HARMONY Gold will report an increase in interim headline share earnings for its 2021 financial year of up to 219% owing to higher production and an increased gold price.

Commenting in a trading statement today ahead of its interim results announcement, scheduled for Tuesday (February 23), the company added it had also benefited from one-off effects including a significant net gain from its rand-hedging activities.

Net profit would come in at between R5.7bn and R5.9bn which would be between 325% and 339% higher year-on-year. In US dollar terms, the increase would be 283% and 297% coming out at between $349m and $361m compared to the first half of 2020.

In US dollar terms, headline share earnings would be 47 and 49 US cents or 175% and 189% higher than the previous comparable period which was 17 US cents per share.

The average gold price received increased by 31% to R896,587/kg in the first half from R683,158/kg in the first half of its 2020 financial year. In US dollar terms, the average gold price received increased by 19% to $1,716/oz from $1,447/oz last financial year.

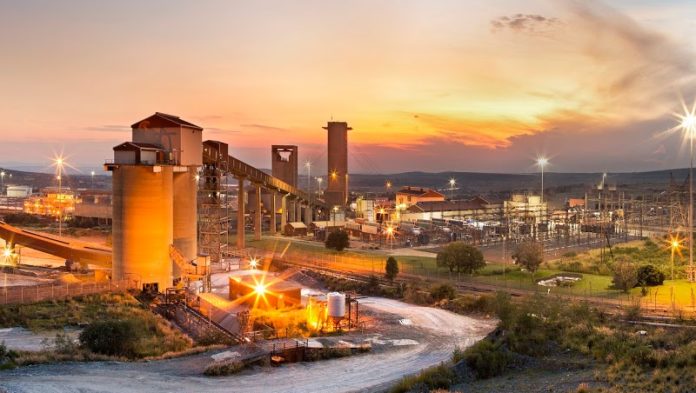

Harmony concluded the purchase for $300m of the West Rand mine, Mponeng, and Mine Waste Solutions from AngloGold Ashanti. It said today that the acquired assets contributed R3bn ($192m) in revenue and R2bn ($128m) in production costs