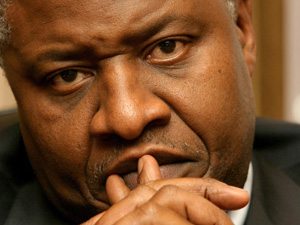

[miningmx.com] – SIPHO Nkosi, CEO of Exxaro Resources, has urged the South African government to take a more mature attitude towards foreign investment and the country’s mining assets and not to behave “like kids”.

Speaking to Business Times, in an article republished by BDLive, Nkosi added, however, that foreign investors would weigh up the risks of investing in South Africa against the hazards of investment in other mining regimes.

Nkosi’s comments comes two weeks after mines minister, Susan Shabangu, told Anglo American that its mining permits would be examined for compliance in the wake of plans by Anglo American Platinum (Amplats) – since postponed – to restructure its mines with the potential loss of 14,000 jobs.

“I think investors will be very concerned,” Nkosi told Business Times. “That kind of talk does not send a good message. I find it concerning, really,’ he said.

“If we continue to make these utterances in public, we behave like kids and we chase investors away.’ Nkosi added that it was “imperative’ that the minister used the Indaba Mining Conference in Cape Town this week to ease investor fears.

At the same time, South Africa had a solid institutional and services background when compared to competitors in the rest of Africa, for instance. That would work in the country’s favour, he said.

“People say, “We can go to any country’. We operate in South Africa and we operate in other countries where the challenges we face may not lead to the kind of violence we see here, but it is just as difficult in these countries as it is in South Africa in terms of delays, in terms of all kinds of things,’ Nkosi told Business Times.

He added that as long as Exxaro Resources offered value, it would continue to attract investment. “If investors believe there is value in what we do as Exxaro, they will continue supporting us. I mean, where else would you go and look for resources? The rest of Africa, South America?